Strategy, Finance and Leadership

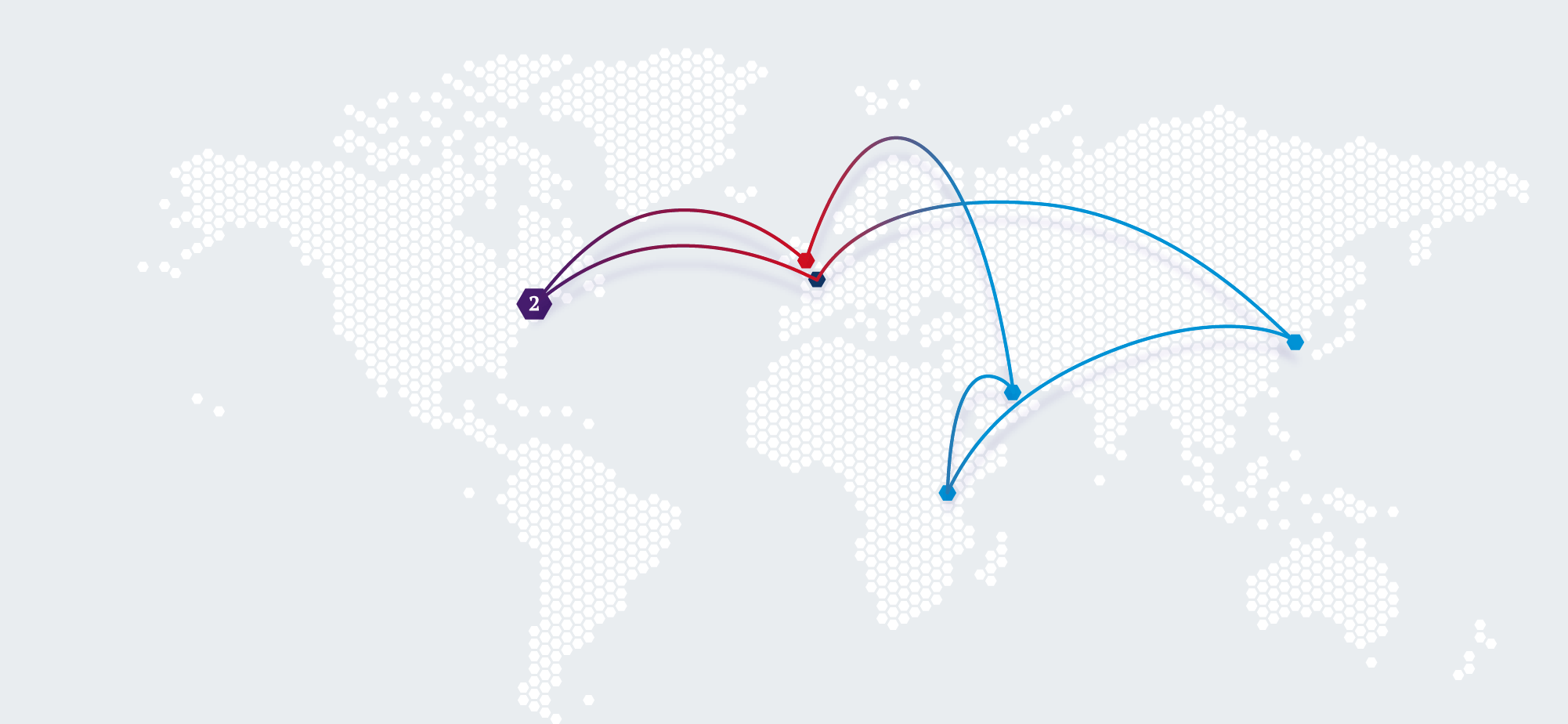

Module 2

New York, USA 11-23 January 2026

This module focuses on the strategic and financial dimensions of business, using quantitative and other analytical tools. Courses cover finance, strategy, data analytics, risk and leadership, delivered by some of NYU Stern’s top-rated professors.

Module themes

Module 2 focuses on finance, giving you the technical, quantitative and analytic foundation that all business leaders need fluency in. We introduce the key concepts and analytical tools that are the building blocks for all financial analysis.

We will explore advanced finance topics, including valuation. We will cover the primary approaches for valuation and apply techniques to value fixed income securities and equities, as well as cover debt and equity instruments and markets.

We cover the concepts and tools required to devise competitive and analytic strategies that enable firms to deliver superior value to chosen customers while simultaneously capturing a sufficient share of that value.

We examine how data can (and cannot) be used to make significant strategic decisions within organizations.

We look at the measurement and management of risk, examining the models and frameworks that underpin much of modern risk-management. We examine the evolution and current status of credit risk models and applications for predicting corporate distress, using techniques pioneered by faculty at NYU and others.

We spend time analyzing both firms and countries from macro-financial and firm-level perspectives, assessing the impact that both financial crisis and recovery has on yields and returns in risky debt markets, and how to understand the risk and return trade-offs using prediction models and other tools.

Featured faculty

Professor Sonia Marciano

Academic Director, TRIUM, NYU

Hide BioProfessor Marciano joined New York University Stern School of Business as a Clinical Associate Professor of Management and Organisations in July 2007. Prior to joining NYU Stern she taught Strategy at Columbia Business School and was an Institute Fellow and Senior Lecturer at Harvard University’s Institute for Strategy and Competitiveness.

Faculty focus

Professor Viral V. Acharya

C.V. Starr Professor of Economics

Hide BioViral V. Acharya is the C.V. Starr Professor of Economics in the Department of Finance at New York University Stern School of Business (NYU-Stern). Viral was a Deputy Governor at the Reserve Bank of India (RBI) during 23rd January 2017 to 23rd July 2019 in charge of Monetary Policy, Financial Markets, Financial Stability, and Research. He has been an Academic Advisor to the Federal Reserve Banks of Chicago, Cleveland, New York and Philadelphia, and the Board of Governors, and provided Academic Expert service to the Bank for International Settlements, the International Monetary Fund and the World Bank. He is a member of the Climate-related Financial Risk Advisory Committee (CFRAC) of the Financial Stability Oversight Council for 2023-26.

Professor Aswath Damodaran

Kerschner Family Chair in Finance Education and Professor of Finance at NYU

View BioProfessor Aswath Damodaran

Kerschner Family Chair in Finance Education and Professor of Finance at NYU

Hide BioAswath’s contributions to the field of Finance have been recognized many times over, with numerous awards. Before coming to Stern, Aswath lectured in Finance at the University of California, Berkeley.

Faculty focus

Professor Suzy Welch

Professor of Management Practice, NYU Stern

Hide BioSuzy Welch joined New York University Stern School of Business as a Professor of Management Practice in September 2023. She is a business journalist and best-selling author with expertise in leadership, change, corporate governance, and career development. Welch is also a senior advisor to the Brunswick Group (a CEO advisory firm), a regular contributor on CNBC and The Today Show, and a frequent speaker and moderator at corporate events.

Professor Randall P White

Co-head of Leadership at HEC Paris and TRIUM

Hide BioDr. White has continually participated in the advancement of consulting psychology for leadership development. He serves on the Division 13 Coaching Psychology Credentialing Committee and is a reviewer for the Consulting Psychology Journal, as well as several other scholarly journals. He is a former president of the Society of Consulting Psychology (SCP), Division 13 of the American Psychological Association, a Fellow in Divisions 1 and 13 of the American Psychological Association (APA), a Salzburg Fellow on Women’s Issues and a former board member of the American Society for Training and Development. In 1987, Dr. White co-authored the best-selling business book, Breaking The Glass Ceiling: Can Women Reach The Top Of America’s Largest Corporations?; and in 1996, The Future of Leadership: Riding the Corporate Rapids into the 21st Century. Dr. White also co-authored Four Essential Ways That Coaching Can Help Executives in 1998 and Relax, It’s Only Uncertainty in 2001, which culminated in the development of Ambiguity Architect, a 360 assessment that measures the ability to cope with uncertainty. In 2009, he contributed the capstone chapter to The Perils of Accentuating the Positive, challenging the strengths-based leadership movement. Much of Dr. White’s work appears in multiple Western languages and Chinese. Dr. White holds an AB from Georgetown University, an MS from Virginia Polytechnic Institute and a PhD in social psychology from Cornell University. He is the former Director of Specialized Client Applications at the Center for Creative Leadership, where he was responsible for all custom programs and executive coaching, and has taught at the Johnson Graduate School of Management at Cornell.

Professor Foster J. Provost

Ira Rennert Professor of Entrepreneurship, Professor of Technology, Operations, and Statistics, Professor of Data Science

View BioProfessor Foster J. Provost

Ira Rennert Professor of Entrepreneurship, Professor of Technology, Operations, and Statistics, Professor of Data Science

Hide BioFor more than 25 years, Professor Provost has helped leaders in business and government understand how data science, artificial intelligence, and machine learning technologies can add value. His book Data Science for Business is required reading in many of the top business schools, and was listed as one of Fortune Magazine's "must read books for MBAs." He has designed AI/machine learning systems for some of the largest companies in the world and worked with the DoD on the application of AI/machine learning to counter-terrorism.

Class of 2024 with Professor Damodaran

NYU Stern

Alumni perspectives

David Gutierrez

Colombia Class of 2020Being a man who loves numbers, I have to say our Valuation class with Professor Damodaran was a unique experience. His mastery of the topic along with his ability to convey complex business scenarios in a simple and entertaining fashion is impressive.

Nisha Kesavan

India Class of 2020I never thought number crunching would be so much fun! Quantitative Analysis with Dr Matt Mulford and Valuation with Professor Aswath Damodaran were just spectacular. Learning was never more fun than in these classes; their ability to teach processing numbers with a story is too brilliant.

Felipe Padilla Gomez

Mexico Class of 2009TRIUM provided me with some of the key capabilities and resources I needed to become a global leader in my industry. The TRIUM EMBA program is an incredible journey that transformed every aspect of my life.

Explore the modules

London

7-19 September 2025

Seoul

12-22 July 2026